E-rasing obstacles to effective clinical trials

By Ian R. Lazarus, FACHE

Managers involved in clinical trial design, execution and monitoring face and expanding range of technologies that make the discovery process more efficient. More and more clinical research organizations (CROs) and e-pharma providers are offering them to win bids for new business.

New research tools could not have come at a better time. According to a recent study by Accenture, the pharma industry will have to increase the number of drug targets by 50 percent to reach its own published ten-year growth projections. This article reviews some of the major technology developments affecting clinical trials and highlights those that offer the greatest benefit to the industry.

From Plants and Paper

Although clinical trials have evolved dramatically, the research methodologies used to validate new discoveries have, until now, remained largely unaltered. By the 1970s, the industry that had based its studies on plants and animals in the early 20th century shifted to the field of molecular biology, focusing on DNA, RNA, and enzyme research. It then turned its attention to combinatorial chemistry and biotechnology and in the 1980s, scientists began to synthesize human proteins. The recent major advance of gene mapping will remain the focus of most future drug discovery efforts. Despite those remarkable achievements, the field of clinical research has changed very little.

Concerns about reliability, security, and privacy have caused it to lag behind other sectors in adopting technology to automate routine processes. In fact, 95 percent of clinical trials remain largely paper based. The underlying fundamentals of industrial clinical trials are shifting as more technology tools become integrated with new trial activity. Today, the biggest challenge for new trials is the expanding range of alternatives those new technologies represent.

Technology Toolbox

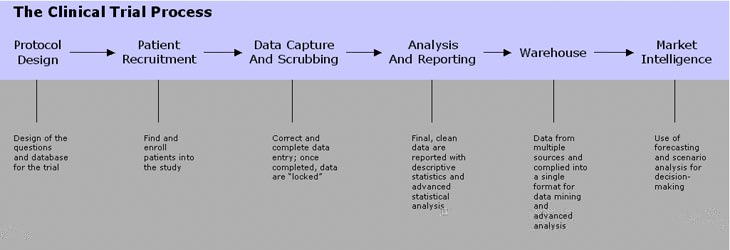

Although many dependable technologies support clinical trials, industry executives involved in Phase I-III clinical trials need to understand the underlying mechanics and benefits of alternative research methodologies. Following is a brief review of what falls into a contemporary definition of an e-pharma clinical trial.

Automated protocol design. Because no mechanism exists for transferring institutional knowledge from trial to trial, discovery efforts are notorious for reinventing the wheel. To leverage productions capability, software manufacturers have created expert systems that standardize protocol design and are developing a “virtual library” of data and experiences that can accelerate new trial designs. The software’s output is a carefully designed research and treatment plan that defines the project objective and allocates budgets and costs. It will even create a standardized workplan, including the types of patients to target and the information to be gathered. Such systems automatically generate case report forms and source documents, allowing for the timely launch of new trials.

Web-based patient recruitment. The difficulty of identifying, qualifying, and enrolling patients often delays clinical trials. Lehman Brothers, an investment banking firm that tracks the pharma industry, estimates that patient recruitment problems account for 25 percent of the delays in clinical trials and nearly 75 percent of missed Phase III deadlines.

The recruitment effort relies heavily on investigators’ existing patient populations. A much smaller proportion of enrollees responds to television and radio ads than to investigators’ requests. The Internet, on the other hand, is a potentially more cost-effective medium for attracting patients.

Aventis used the Web to attract patients for the development and testing of Rilutek (riluzole) for the treatment of Parkinson’s disease. Its user-friendly website helped the trial meet its testing deadlines, and nearly all of the patients who inquired through the site qualified to participate. Databases generated by such websites also can be “mined” later to identify candidates for future studies.

Data capture and trial monitoring. Electronic data capture (EDC) encompasses a growing range of alternatives for collecting clinical trial data, including the Internet, interactive voice response (IVE) systems, and wireless devices. EDC allows data to be entered directly into an electronic system without the overhead of manual transcription and subsequent data entry.

EDC is invaluable. According to Lehman Brothers, up to 12 percent of a trial’s data errors result from incomplete case report forms, and another 20 percent is inconsistent with midtrial corrections in study design. Many investigators fail to verify data by signing their input forms, jeopardizing studies that come under close FDA scrutiny.

A key advantage of EDC is that investigators perform it as they collect data. Data scrubbing can happen simultaneously. Computer programs immediately flag and resolve incomplete records, and investigators can verify and sign forms with one keystroke. After sufficient documentation, the databases lock automatically.

Data scrubbing

Another source of inefficiency in clinical trials is transcribing incorrect data from paper-based records. Because investigators must currently input data manually, a third party must interpret that data, and the risk of error is high. Recent disclosures from the Institute of Medicine draw attention to just how dangerous those errors can be. Even one death from a hospital medication error is too many. New software tools, supported in real time by web-based programs, analyze data at the point of entry to correct range values and required fields. The system alerts users to potentially invalid data and prompts them about the need for possible corrections. That greatly reduces the amount of time the database is closed for analysis and may even save a trial from premature termination.

Data warehousing

A data warehouse is a central repository for all significant data a company collects. Users extract data selectively and organize it for analysis from chosen sources. Aggregating data across multiple studies allows more accurate reporting and analysis.

Although most CROs and CRO technology suppliers purport to offer data warehousing as part of clinical trials, the information’s value is a function of the ability to analyze that data across studies and patient populations. As more studies use the Web to capture feedback directly from patients, the value of the data warehouse becomes even greater, affecting not only the process of drug discovery but sales and marketing as well.

Data mining

Data warehousing leads inevitably to another key competitive advantage for early adopters of the technology: the ability to identify new relationships. That process, known as data mining, can affect clinical trials in several ways, including interactions with other pharmaceuticals and the discovery of a broader use for the compound, increasing its market potential. Data mining can help establish safety data and possible price points for products, but with many technology devices, the value of the output depends not only on the quality of the input but on the end-users’ perseverance.

A New Model

Advanced technology suppliers are teaming up with traditional CROs to offer many of those capabilities through a single integrated system. Schering-Plough is currently using web-based, wireless, and voice technology from ClickFindMed for its large multisite clinical trials, in which more than 15,000 patients are enrolled. Similarly, more than 20,000 patients have enrolled electronically through etrials.com, another emerging e-pharma supplier.

ClickTrials enables companies to store patient data obtained from clinical trials in real time and to control and distribute it from a central web-enabled location. Or users can enter information using a handheld device or a telephone. Information collected from all sources is stored in a secure, shared database.

Besides making all data available on demand, EDC is an efficient method for processing the information collected during clinical trials. No data is recorded on paper at the point of service, reducing the number of input errors and the time spent between collection and electronic conversion for data scrubbing. All processed data is stored in “XML” format, the newest technology for controlling data movement and integration into existing systems. The result is the lowest cost and fastest progress of any research initiative.

“There is no question of the cost savings,” says Paul Scheifer, vice-president of biostatistics for Dow Pharmaceuticals and a client of the online company e-trials. “It used to take me months to compile, review, monitor, correct, copy, and express mail studies.”

Dow Pharmaceuticals recently abandoned its in-house efforts to create an EDC system, because reliable suppliers are available to take responsibility for the process’ IT components.

The Race Begins

Stories of how new research technologies are being deployed have reached the mainstream market. Amgen released information about its efforts to use web-based tools to support patient recruitment, trial management, and data capture. Through partnerships with its technology suppliers, the company launched a clinical trials website to manage relationships with investigators.

Benefits from that investment include expedited payment for investigators, automated patient scheduling and tracking, and enhanced communication between developments and marketing departments. And, according to Amgen executives, regulatory compliance is a natural byproduct of efforts to implement digital data-capture tools because of the secure nature of the electronic filing process.

Johnson & Johnson’s recent purchase of Alza is an example of its effort to acquire products and technologies within its therapeutic portfolio, because the company’s own efforts at drug development had become bogged down in the inefficiencies of obsolete research methods. But that, too, may change, according to a recent day-long performance review of the company’s research division, which was conducted for industry analysts.

In a break with tradition, the company took time from a routine briefing to reveal its plan for improving the clinical trial process in the early stages of research. “One in ten is not good enough,” says William Weldon, a J&J vice-chairman, in reference to the current industry average for success sin trials. “We need to get better.”

New technologies can help companies conduct clinical research more efficiently and with higher levels of statistical accuracy. Not only do they enhance the speed and quality of clinical research through the use of security and encryption tools that are fully integrated into the new systems, but they may assure compliance with federal regulations. Furthermore, researchers can, at any point, determine the status of a trial, correct its course, validate new benefits, or terminated unproductive trials without incurring the time and expense involved in processing an entire patient population.

That accelerated cycle will help the industry move toward the increase in drug targets that is necessary to tap the enormous amount of genomic data. It will also enable pharma companies to maintain the growth trajectories the public demands. By all apparent measures, the promise of new technologies in clinical research is effective medicine for an industry that takes pride in being on the cutting edge.

Ian Lazarus is managing partner of Creato Performance Solutions (www.creato.com). Mr. Lazarus may be contacted at irl@creato.com.